Chinese financial statistics

Any snapshot of how a country's economy is performing relies on statistics. These give an excellent overview, with all the complex machinations involved in trade, commerce and retail trends drilled right down to the bare bones of the facts and figures.

Chinese Exports Exports in China are reported by the General Administration of Customs. According to that office, Chinese exports increased to 1992.30 hundred million US dollars from 1793.81 hundred million US dollars between November and December 2012.

Chinese Imports The same organisation stated that the same period imports to China increased from 1597.47 hundred million US dollars to 1676.11hundred million US dollars.

Consumer spending Figures on consumer spending in China are collated by the National Bureau of Statistics, China. The figures increased from creased from 133290.90 CNY HML to 164945.20 CNY HML from 2010 to 2011.

Balance of trade According to the General Administration of Customs, the Chinese economy recorded a trade surplus of 316.18 hundred million US dollars during December 2012.

Consumer Price Index The China Consumer Price Index, or CPI, increased by 102.50 index points from 102 between November and December 2012, as reported by the National Bureau of Statistics, China.

Inventories The Bureau of Statistics also recorded that changes in inventories in China had increased from 9988.70 CNY HML to 11963.50 CNY HML from 2010 to 2011.

Prime Lending Rate The bank lending rate in China remained at 6%in January of this year, compared to 6% in December 2012. The bank lending rate is reported by the People's Bank of China.

Export prices Export Prices in China increased to 99.50 Index Points in November of 2012 from 99.30 Index Points in October of 2012. Export Prices in China is reported by the National Bureau of Statistics, China.

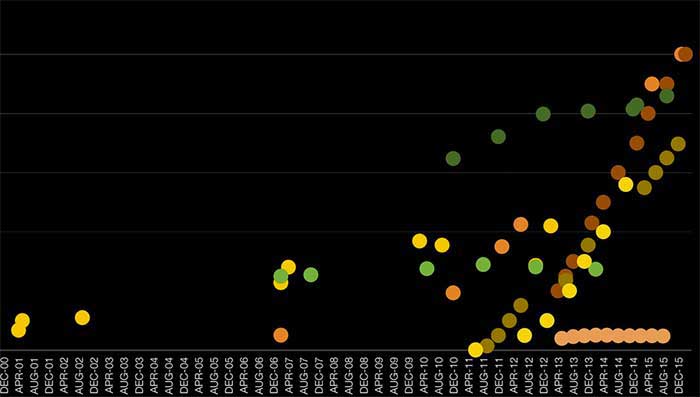

Capital Flows As reported by the State Administration of Foreign Exchange, China, Chinese capital flows increased to 2210.56 hundred million US dollars in 2011 from 286.86 hundred million US dollars in 2010.

Foreign Exchange Reserves The People's Bank of China.reported that China's Foreign Exchange Reserves rose to 3310000 hundred million US dollars in December of 2012 from 3285095 hundred million US dollars in September of 2012.